It hasn't been a great afternoon session for T-Mobile US investors, who have watched their shares sink by -2.2% to a price of $252.41. Some of you might be wondering if it's time to buy the dip. If you are considering this, make sure to check the company's fundamentals first to determine if the shares are fairly valued at today's prices.

T-Mobile US's Valuation Is in Line With Its Sector Averages:

T-Mobile US, Inc., together with its subsidiaries, provides wireless communications services in the United States, Puerto Rico, and the United States Virgin Islands. The company belongs to the Telecommunications sector, which has an average price to earnings (P/E) ratio of 18.22 and an average price to book (P/B) ratio of 1.86. In contrast, T-Mobile US has a trailing 12 month P/E ratio of 23.9 and a P/B ratio of 4.66.

T-Mobile US has moved 30.0% over the last year compared to 13.1% for the S&P 500 — a difference of 16.9%. T-Mobile US has a 52 week high of $276.49 and a 52 week low of $192.61.

Generally Positive Cash Flows but Not Enough Current Assets to Cover Current Liabilities:

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|---|

| Revenue (M) | $44,998 | $68,397 | $80,118 | $79,571 | $78,558 | $81,400 |

| Operating Margins | 13% | 10% | 9% | 8% | 18% | 22% |

| Net Margins | 8% | 4% | 4% | 3% | 11% | 14% |

| Net Income (M) | $3,468 | $3,064 | $3,024 | $2,590 | $8,317 | $11,339 |

| Net Interest Expense (M) | $727 | $2,483 | $3,189 | -$3,364 | -$3,335 | -$3,411 |

| Depreciation & Amort. (M) | $6,616 | $14,151 | $16,383 | $13,651 | $12,818 | $12,100 |

| Diluted Shares (M) | 864 | 1,252 | 1,255 | 1,255 | 1,200 | 1,173 |

| Earnings Per Share | $4.02 | $2.65 | $2.41 | $2.06 | $6.93 | $9.66 |

| EPS Growth | n/a | -34.08% | -9.06% | -14.52% | 236.41% | 39.39% |

| Avg. Price | $75.39 | $103.89 | $130.23 | $125.25 | $160.33 | $252.9 |

| P/E Ratio | 18.57 | 38.76 | 53.81 | 60.51 | 22.84 | 26.07 |

| Free Cash Flow (M) | $433 | -$2,394 | $1,591 | $2,811 | $8,758 | $13,453 |

| CAPEX (M) | $6,391 | $11,034 | $12,326 | $13,970 | $9,801 | $8,840 |

| EV / EBITDA | 7.13 | 7.43 | 9.95 | 11.09 | 9.93 | 12.52 |

| Total Debt (M) | $25,444 | $75,704 | $76,438 | $71,960 | $78,637 | $82,333 |

| Net Debt / EBITDA | 1.94 | 3.14 | 3.0 | 3.34 | 2.71 | 2.55 |

| Current Ratio | 0.74 | 1.1 | 0.89 | 0.77 | 0.91 | 0.91 |

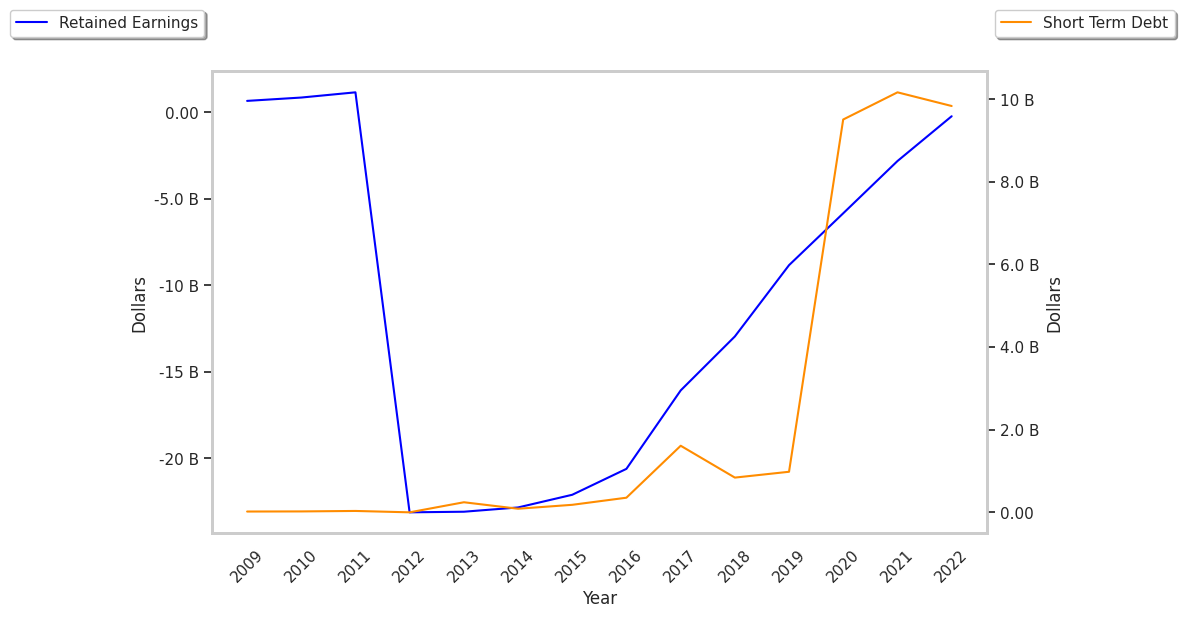

T-Mobile US has strong operating margins with a positive growth rate and generally positive cash flows. Additionally, the company's financial statements display growing revenues and a flat capital expenditure trend and a strong EPS growth trend. However, the firm has not enough current assets to cover current liabilities because its current ratio is 0.91. Finally, we note that T-Mobile US has significant leverage levels.