Exact Sciences logged a -0.7% change during today's morning session, and is now trading at a price of $52.06 per share.

Exact Sciences returned losses of -22.7% last year, with its stock price reaching a high of $72.83 and a low of $38.81. Over the same period, the stock underperformed the S&P 500 index by -39.0%. AThe company's 50-day average price was $48.93. Exact Sciences Corporation provides cancer screening and diagnostic test products in the United States and internationally. Based in Madison, WI, the Mid-Cap Health Care company has 6,900 full time employees. Exact Sciences has not offered a dividend during the last year.

Increasing Revenues but Narrowing Margins:

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|---|

| Revenue (M) | $876 | $1,491 | $1,767 | $2,084 | $2,500 | $2,759 |

| Net Margins | -24% | -55% | -34% | -30% | -8% | -37% |

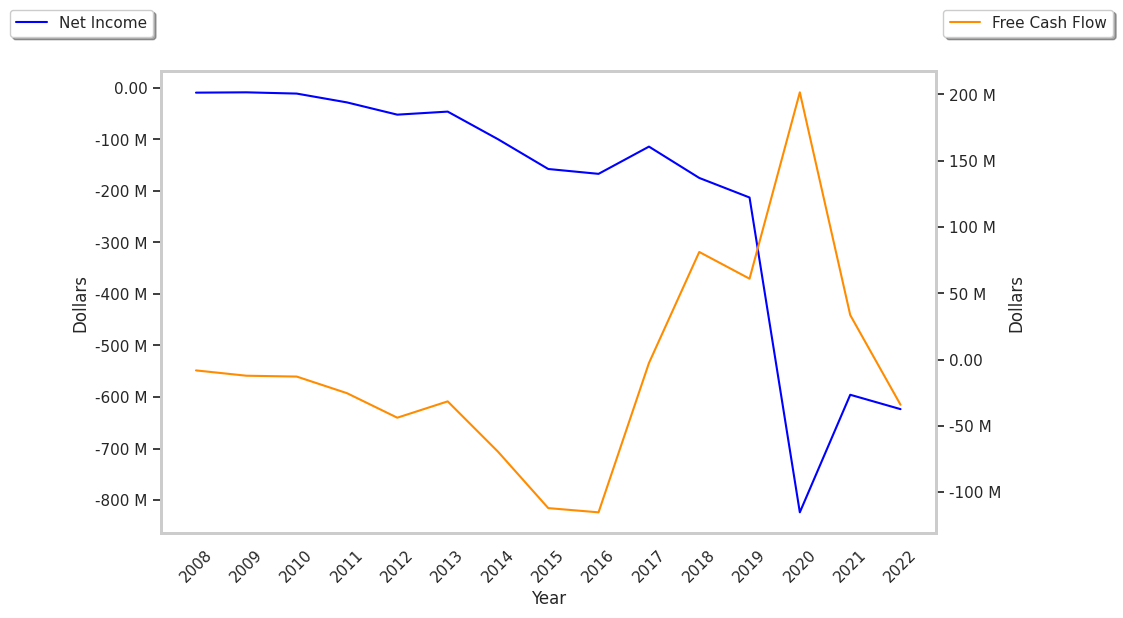

| Net Income (M) | -$213 | -$824 | -$596 | -$624 | -$204 | -$1,029 |

| Net Interest Expense (M) | -$62 | $68 | $19 | $20 | $19 | $16 |

| Depreciation & Amort. (M) | $16 | $93 | $95 | $97 | $92 | $120 |

| Diluted Shares (M) | 143 | 156 | 172 | 176 | 181 | 185 |

| Earnings Per Share | -$1.62 | -$5.45 | -$3.48 | -$3.54 | -$1.13 | -$5.59 |

| EPS Growth | n/a | -236.42% | 36.15% | -1.72% | 68.08% | -394.69% |

| Avg. Price | $97.06 | $92.23 | $112.2 | $62.55 | $73.98 | $52.41 |

| P/E Ratio | -59.91 | -16.92 | -32.24 | -17.67 | -65.47 | -9.38 |

| Free Cash Flow (M) | -$284 | $71 | -$238 | -$438 | $32 | $75 |

| CAPEX (M) | $173 | $65 | $136 | $214 | $124 | $136 |

| Current Ratio | 2.34 | 3.47 | 2.76 | 2.38 | 2.32 | 2.15 |

Exact Sciences does not have a meaningful trailing P/E ratio since its earnings per share are negative. Its forward EPS guidance is negative too, at $-0.34. The average P/E ratio for the Health Care sector is 22.94. Furthermore, Exact Sciences is likely overvalued compared to the book value of its equity, since its P/B ratio of 3.99 is higher than the sector average of 3.19. In conclusion, Exact Sciences's impressive cash flow trend, decent P/B ratio, and reasonable use of leverage demonstrate that the company may still be fairly valued -- despite its elevated earnings multiple.

There's an Analyst Consensus of Some Upside Potential for Exact Sciences:

The 23 analysts following Exact Sciences have set target prices ranging from $50.0 to $85.0 per share, for an average of $64.01 with a buy rating. The company is trading -18.7% away from its average target price, indicating that there is an analyst consensus of some upside potential.

Exact Sciences has an average amount of shares sold short because 4.4% of the company's shares are sold short. Institutions own 95.6% of the company's shares, and the insider ownership rate stands at 0.91%, suggesting a small amount of insider investors. The largest shareholder is FMR, LLC, whose 14% stake in the company is worth $1,400,014,007.