One of Wall Street's biggest winners of the day is Regeneron Pharmaceuticals, a pharmaceutical company whose shares have climbed 6.7% to a price of $600.09 -- 16.91% below its average analyst target price of $722.2.

The average analyst rating for the stock is buy. REGN may have outstripped the S&P 500 index by 7.0% so far today, but it has lagged behind the index by 63.1% over the last year, returning -45.9%.

Regeneron Pharmaceuticals, Inc. discovers, invents, develops, manufactures, and commercializes medicines for treating various diseases worldwide. The company is categorized within the healthcare sector. The catalysts that drive valuations in this sector are complex. From demographics, regulations, scientific breakthroughs, to the emergence of new diseases, healthcare companies see their prices swing on the basis of a variety of factors.

Regeneron Pharmaceuticals's trailing 12 month P/E ratio is 15.2, based on its trailing EPS of $39.58. The company has a forward P/E ratio of 14.6 according to its forward EPS of $45.31 -- which is an estimate of what its earnings will look like in the next quarter.

The P/E ratio is the company's share price divided by its earnings per share. In other words, it represents how much investors are willing to spend for each dollar of the company's earnings (revenues minus the cost of goods sold, taxes, and overhead). As of the third quarter of 2024, the health care sector has an average P/E ratio of 22.94, and the average for the S&P 500 is 29.3.

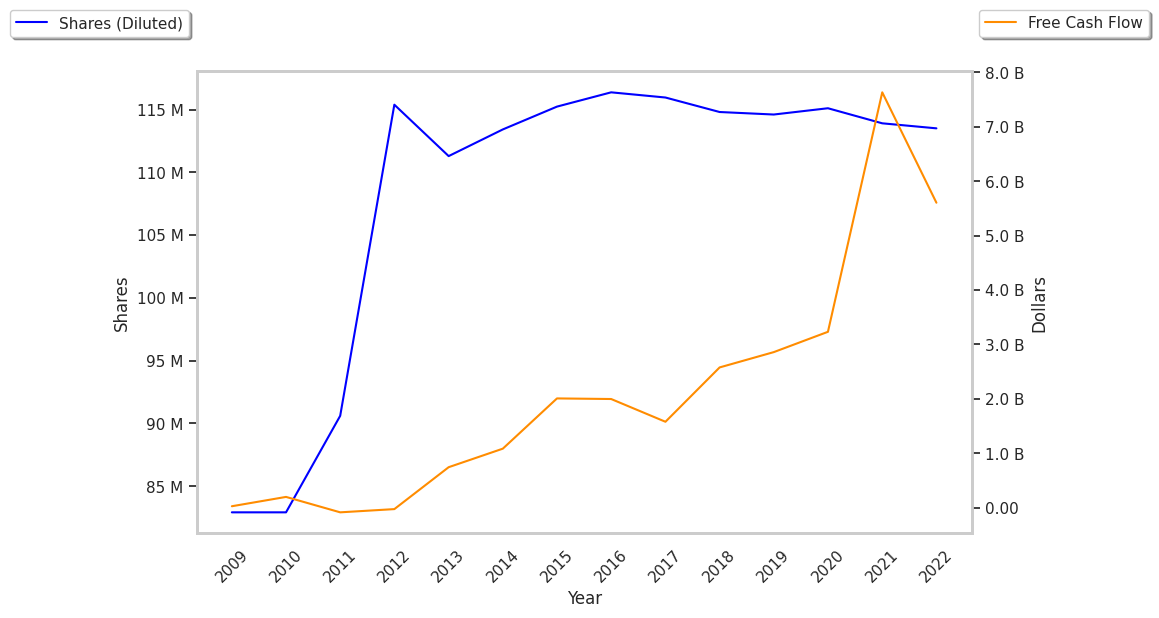

Regeneron Pharmaceuticals's financial viability can also be assessed through a review of its free cash flow trends. Free cash flow refers to the company's operating cash flows minus its capital expenditures, which are expenses related to the maintenance of fixed assets such as land, infrastructure, and equipment. Over the last four years, the trends have been as follows:

| Date Reported | Cash Flow from Operations ($ k) | Capital expenditures ($ k) | Free Cash Flow ($ k) | YoY Growth (%) |

|---|---|---|---|---|

| 2024 | 4,420,500 | 755,900 | 3,664,600 | -5.44 |

| 2023 | 4,594,000 | 718,600 | 3,875,400 | -12.42 |

| 2022 | 5,014,900 | 590,100 | 4,424,800 | -32.23 |

| 2021 | 7,081,300 | 551,900 | 6,529,400 | 225.9 |

| 2020 | 2,618,100 | 614,600 | 2,003,500 | 0.15 |

| 2019 | 2,430,000 | 429,600 | 2,000,400 |

- Average free cash flow: $3.75 Billion

- Average free cash flown growth rate: 12.9 %

- Coefficient of variability (lower numbers indicating more stability): 0.0 %

With its positive cash flow, the company can not only re-invest in its business, it can offer regular returns to its equity investors in the form of dividends. Over the last 12 months, investors in REGN have received an annualized dividend yield of 0.3% on their capital.

Another valuation metric for analyzing a stock is its Price to Book (P/B) Ratio, which consists in its share price divided by its book value per share. The book value refers to the present liquidation value of the company, as if it sold all of its assets and paid off all debts.

Regeneron Pharmaceuticals has a P/B ratio of 2.09. This indicates that the market value of the company exceeds its book value by a factor of more than 2, but is still below the average P/B ratio of the Health Care sector, which stood at 3.19 as of the third quarter of 2024.

With a Very low P/E ratio, a lower P/B ratio than its sector average, and generally positive cash flows with an upwards trend, we can conclude that Regeneron Pharmaceuticals is probably undervalued at current prices. The stock presents strong growth indicators because of its decent operating margins with a negative growth trend, and an average PEG ratio.