Steel Dynamics, Inc. has announced the appointment of Matt Bell as the head of its metals recycling platform, effective immediately. Bell has been recognized for his outstanding leadership and positive impact within the company since joining in 2016. His commercial and operational experience has led the metals recycling teams to higher levels of service, efficiency, supply-chain solutions, and excellence. As Vice President of Commercial for OmniSource since 2023, Bell has been responsible for developing and implementing ferrous purchasing and sales growth strategies, optimizing the scrap supply for the company's steel operations. In his new role, Bell will assume responsibility and oversight for the company's metals recycling platform as the Vice President of Metals Recycling and the President of OmniSource.

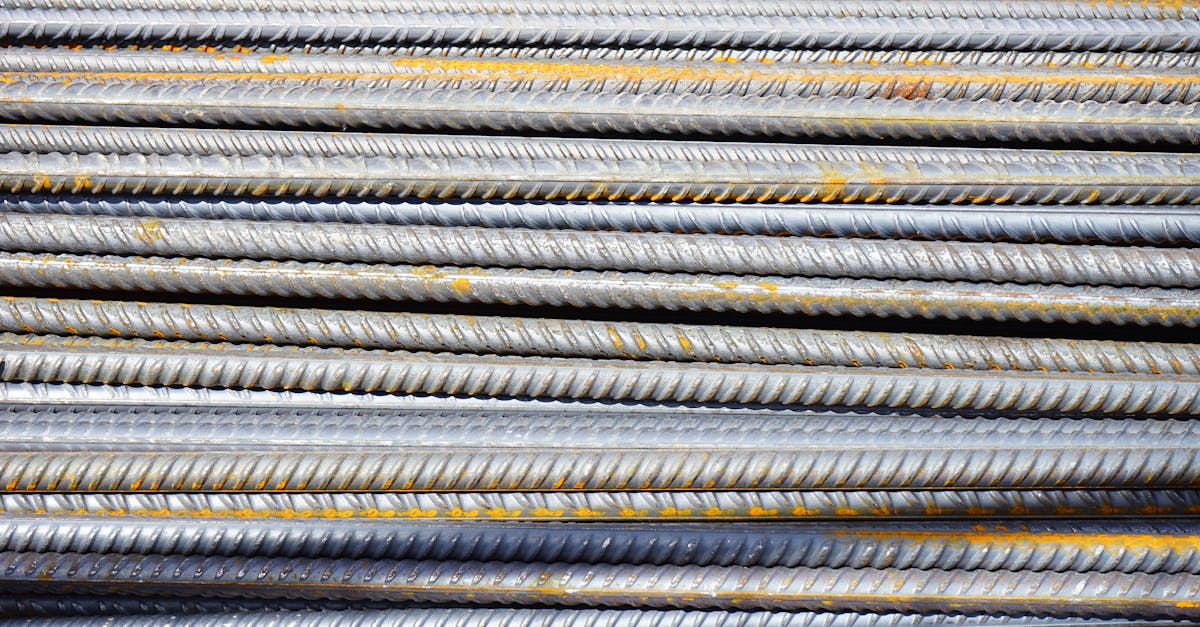

Steel Dynamics, Inc. operates using a circular manufacturing model, producing lower-carbon-emission, quality products with recycled scrap as the primary input. The company is one of the largest domestic steel producers and metal recyclers in North America, and it is currently investing in aluminum operations to diversify its product offerings.

This announcement comes as part of the company's ongoing succession planning, with Matt Bell taking over from Miguel Alvarez, who is transitioning from metals recycling to leading the company's aluminum flat rolled products platform. Steel Dynamics, Inc. is committed to operating with the highest integrity and being the safest, most efficient producer of high-quality, broadly diversified, value-added metal products. Today the company's shares have moved 4.09% to a price of $158.615. For the full picture, make sure to review STEEL DYNAMICS INC's 8-K report.