It's been a great afternoon session for Alphabet investors, who saw their shares rise 2.9% to a price of $285.13 per share. At these higher prices, is the company still fairly valued? If you are thinking about investing, make sure to check the company's fundamentals before making a decision.

a Very Low P/E Ratio but Priced at a Premium:

Alphabet Inc. offers various products and platforms in the United States, Europe, the Middle East, Africa, the Asia-Pacific, Canada, and Latin America. The company belongs to the Technology sector, which has an average price to earnings (P/E) ratio of 30.44 and an average price to book (P/B) ratio of 4.19. In contrast, Alphabet has a trailing 12 month P/E ratio of 28.1 and a P/B ratio of 8.9.

Alphabet has moved 56.7% over the last year compared to 14.3% for the S&P 500 -- a difference of 42.4%. Alphabet has a 52 week high of $294.5 and a 52 week low of $142.66.

Strong Revenue Growth and Healthy Leverage Levels:

| 2019 | 2020 | 2021 | 2022 | 2023 | 2024 | |

|---|---|---|---|---|---|---|

| Revenue (M) | $161,857 | $182,527 | $257,637 | $282,836 | $307,394 | $350,018 |

| Operating Margins | 21% | 23% | 31% | 26% | 27% | 32% |

| Net Margins | 21% | 22% | 30% | 21% | 24% | 28% |

| Net Income (M) | $34,343 | $40,269 | $76,033 | $59,972 | $73,795 | $100,118 |

| Net Interest Expense (M) | $100 | $135 | $346 | $357 | $308 | $4,482 |

| Depreciation & Amort. (M) | $925 | $792 | $10,273 | $13,475 | $11,946 | $15,311 |

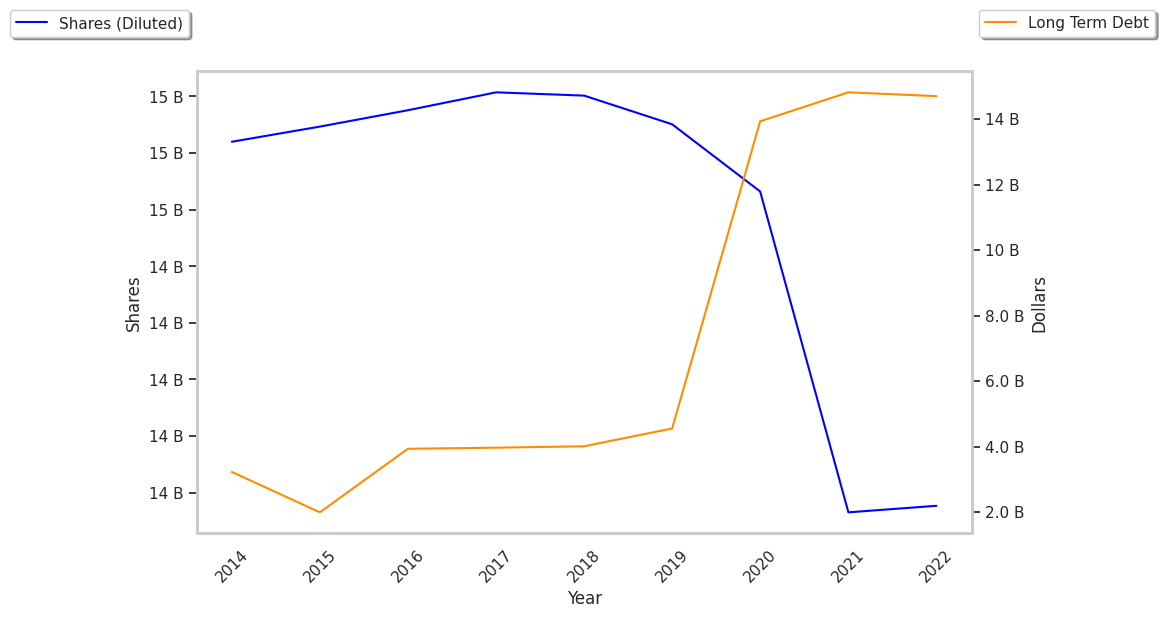

| Diluted Shares (M) | 13,904 | 13,746 | 13,483 | 13,159 | 12,722 | 12,447 |

| Earnings Per Share | $2.47 | $2.93 | $5.64 | $4.56 | $5.8 | $8.04 |

| EPS Growth | n/a | 18.62% | 92.49% | -19.15% | 27.19% | 38.62% |

| Avg. Price | $59.42 | $74.07 | $125.53 | $126.61 | $140.93 | $284.95 |

| P/E Ratio | 24.06 | 25.28 | 22.26 | 27.89 | 24.47 | 35.4 |

| Free Cash Flow (M) | $30,972 | $42,843 | $67,012 | $60,010 | $69,495 | $72,764 |

| CAPEX (M) | $23,548 | $22,281 | $24,640 | $31,485 | $32,251 | $52,535 |

| EV / EBITDA | 23.1 | 23.93 | 18.95 | 18.87 | 18.63 | 27.65 |

| Total Debt (M) | $4,554 | $13,932 | $14,817 | $14,701 | $11,870 | $12,000 |

| Net Debt / EBITDA | -0.4 | -0.3 | -0.07 | -0.08 | -0.13 | -0.09 |

| Current Ratio | 3.37 | 3.07 | 2.93 | 2.38 | 2.1 | 1.84 |

Alphabet has rapidly growing revenues and increasing reinvestment in the business, strong operating margins with a positive growth rate, and exceptional EPS growth. The company also benefits from generally positive cash flows, a decent current ratio of 1.84, and healthy leverage levels.