It's been a great morning session for PayPal investors, who saw their shares rise 1.1% to a price of $61.63 per share. At these higher prices, is the company still fairly valued? If you are thinking about investing, make sure to check the company's fundamentals before making a decision.

A Lower P/E Ratio Than Its Sector Average but Trades Above Its Graham Number:

PayPal Holdings, Inc. operates a technology platform that enables digital payments on behalf of merchants and consumers worldwide. The company belongs to the Consumer Discretionary sector, which has an average price to earnings (P/E) ratio of 22.33 and an average price to book (P/B) ratio of 3.12. In contrast, PayPal has a trailing 12 month P/E ratio of 16.8 and a P/B ratio of 3.45.

When we dividePayPal's P/E ratio by its expected five-year EPS growth rate, we obtain a PEG ratio of 0.84, which indicates that the market is undervaluing the company's projected growth (a PEG ratio of 1 indicates a fairly valued company). Your analysis of the stock shouldn't end here. Rather, a good PEG ratio should alert you that it may be worthwhile to take a closer look at the stock.

The Business Has Operating Margins Consistently Higher Than the 9.03% industry Average:

| 2018-02-07 | 2019-02-07 | 2020-02-06 | 2021-02-05 | 2022-02-03 | 2023-02-10 | |

|---|---|---|---|---|---|---|

| Revenue (MM) | $13,094 | $15,451 | $17,772 | $21,454 | $25,371 | $27,518 |

| Operating Margins | 25% | 24% | 23% | 24% | 21% | 20% |

| Net Margins | 14.0% | 13.0% | 14.0% | 20.0% | 16.0% | 9.0% |

| Net Income (MM) | $1,795 | $2,057 | $2,459 | $4,202 | $4,169 | $2,419 |

| Earnings Per Share | $1.47 | $1.71 | $2.07 | $3.54 | $3.51 | $2.09 |

| EPS Growth | n/a | 16.33% | 21.05% | 71.01% | -0.85% | -40.46% |

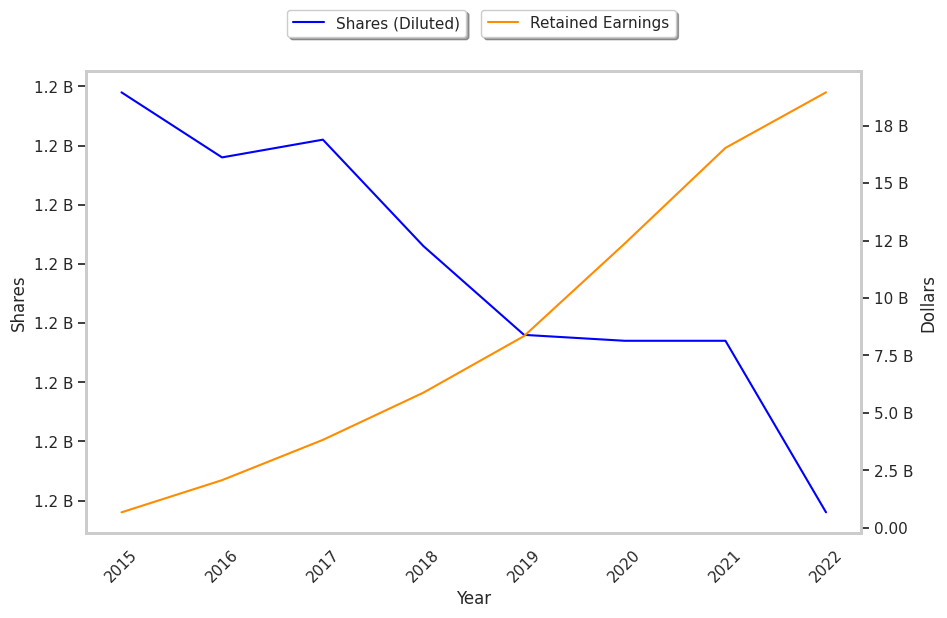

| Diluted Shares (MM) | 1,221 | 1,203 | 1,188 | 1,187 | 1,187 | 1,158 |

| Free Cash Flow (MM) | $3,198 | $6,300 | $4,758 | $6,965 | $6,700 | $6,514 |

| Capital Expenditures (MM) | -$667 | -$820 | -$687 | -$746 | -$903 | -$701 |

| Net Current Assets (MM) | n/a | n/a | $4,091 | $679 | -$1,502 | -$926 |

| Long Term Debt (MM) | n/a | n/a | $4,965 | $8,939 | $8,049 | $10,417 |

PayPal has strong margins with a stable trend, healthy debt levels, and a strong EPS growth trend. Furthermore, PayPal has weak revenue growth and a flat capital expenditure trend, irregular cash flows, and just enough current assets to cover current liabilities.