Large-cap Real Estate company Weyerhaeuser Company has logged a 0.1% change today on a trading volume of 67,215. The average volume for the stock is 3,625,788.

Weyerhaeuser Company, one of the world's largest private owners of timberlands, began operations in 1900. Based in Seattle, United States the company has 9,264 full time employees and a market cap of $24,078,147,584. Weyerhaeuser Company currently offers its equity investors a dividend that yields 2.2% per year.

The company is now trading -14.79% away from its average analyst target price of $38.67 per share. The 9 analysts following the stock have set target prices ranging from $36.0 to $42.0, and on average give Weyerhaeuser Company a rating of buy.

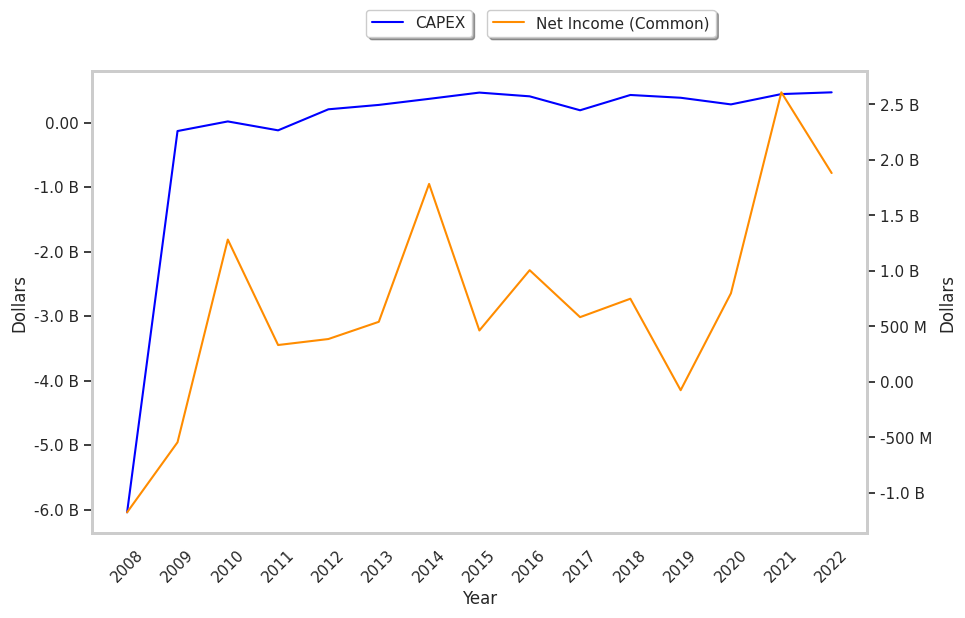

Over the last 52 weeks, WY stock has risen 1.0%, which amounts to a -15.0% difference compared to the S&P 500. The stock's 52 week high is $36.0 whereas its 52 week low is $27.37 per share. Based on Weyerhaeuser Company's average net margin growth of 15.0% over the last 6 years, its core business is on track for profitability and its strong stock performance may continue in the long term.

| Date Reported | Total Revenue ($ k) | Net Profit ($ k) | Net Margins (%) | YoY Growth (%) |

|---|---|---|---|---|

| 2023-02-17 | 10,184,000 | 1,880,000 | 18 | -30.77 |

| 2022-02-18 | 10,201,000 | 2,607,000 | 26 | 136.36 |

| 2021-02-19 | 7,532,000 | 797,000 | 11 | 1200.0 |

| 2020-02-14 | 6,554,000 | -76,000 | -1 | -110.0 |

| 2019-02-15 | 7,476,000 | 748,000 | 10 | 25.0 |

| 2018-02-16 | 7,196,000 | 582,000 | 8 |