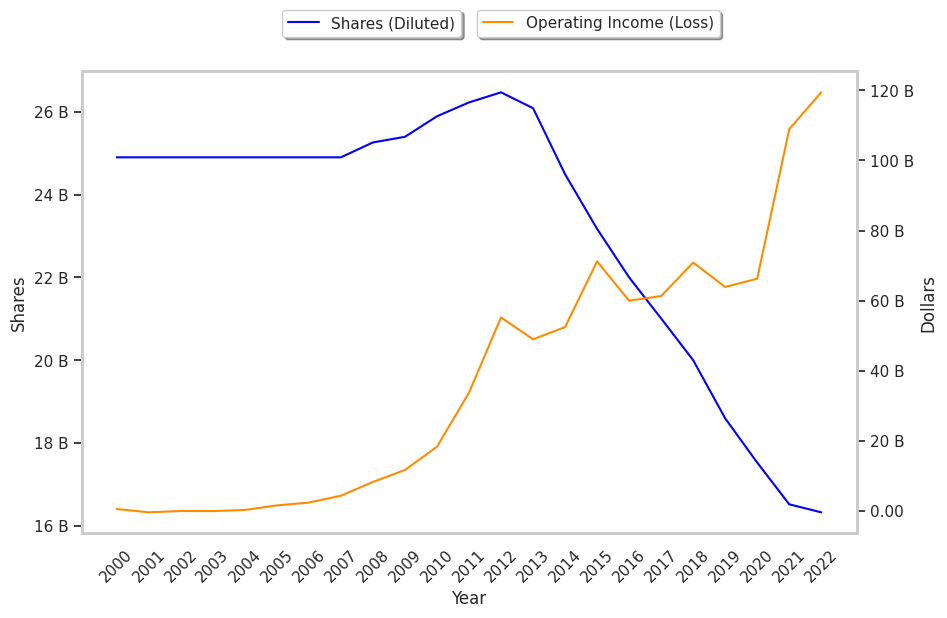

Shares of Technology sector company Apple moved 1.1% today, and are now trading at a price of $172.49. The large-cap stock's daily volume was 11,675,808 compared to its average volume of 58,559,046. The S&P 500 index returned a 1.0% performance.

Apple Inc. designs, manufactures, and markets smartphones, personal computers, tablets, wearables, and accessories worldwide. The company is based in Cupertino and has 164,000 full time employees. Its market capitalization is $2,696,727,494,656. Apple currently offers its equity investors a dividend that yields 0.5% per year.

37 analysts are following Apple and have set target prices ranging from $149.0 to $240.0 per share. On average, they have given the company a rating of buy. At today's prices, AAPL is trading -13.57% away from its average analyst target price of $199.58 per share.

Over the last year, AAPL's share price has increased by 25.0%, which represents a difference of 3.0% when compared to the S&P 500. The stock's 52 week high is $198.23 per share whereas its 52 week low is $124.17.

| Date Reported | Cash Flow from Operations ($ k) | Capital expenditures ($ k) | Free Cash Flow ($ k) | YoY Growth (%) |

|---|---|---|---|---|

| 2022-10-28 | 122,151,000 | -10,708,000 | 132,859,000 | 15.41 |

| 2021-10-29 | 104,038,000 | -11,085,000 | 115,123,000 | 30.85 |

| 2020-10-30 | 80,674,000 | -7,309,000 | 87,983,000 | 10.14 |

| 2019-10-31 | 69,391,000 | -10,495,000 | 79,886,000 | -11.97 |

| 2018-11-05 | 77,434,000 | -13,313,000 | 90,747,000 | 18.35 |

| 2017-11-03 | 64,225,000 | -12,451,000 | 76,676,000 |