PayPal logged a -2.1% change during today's morning session, and is now trading at a price of $53.66 per share.

PayPal returned losses of -36.0% last year, with its stock price reaching a high of $92.62 and a low of $53.44. Over the same period, the stock underperformed the S&P 500 index by -50.0%. As of April 2023, the company's 50-day average price was $60.05. PayPal Holdings, Inc. operates a technology platform that enables digital payments on behalf of merchants and consumers worldwide. Based in San Jose, CA, the large-cap Consumer Discretionary company has 29,900 full time employees. PayPal has not offered a dividend during the last year.

The Business Has Operating Margins Consistently Higher Than the 9.03% industry Average:

| 2018-02-07 | 2019-02-07 | 2020-02-06 | 2021-02-05 | 2022-02-03 | 2023-02-10 | |

|---|---|---|---|---|---|---|

| Revenue (MM) | $13,094 | $15,451 | $17,772 | $21,454 | $25,371 | $27,518 |

| Operating Margins | 25% | 24% | 23% | 24% | 21% | 20% |

| Net Margins | 14.0% | 13.0% | 14.0% | 20.0% | 16.0% | 9.0% |

| Net Income (MM) | $1,795 | $2,057 | $2,459 | $4,202 | $4,169 | $2,419 |

| Earnings Per Share | $1.47 | $1.71 | $2.07 | $3.54 | $3.51 | $2.09 |

| EPS Growth | n/a | 16.33% | 21.05% | 71.01% | -0.85% | -40.46% |

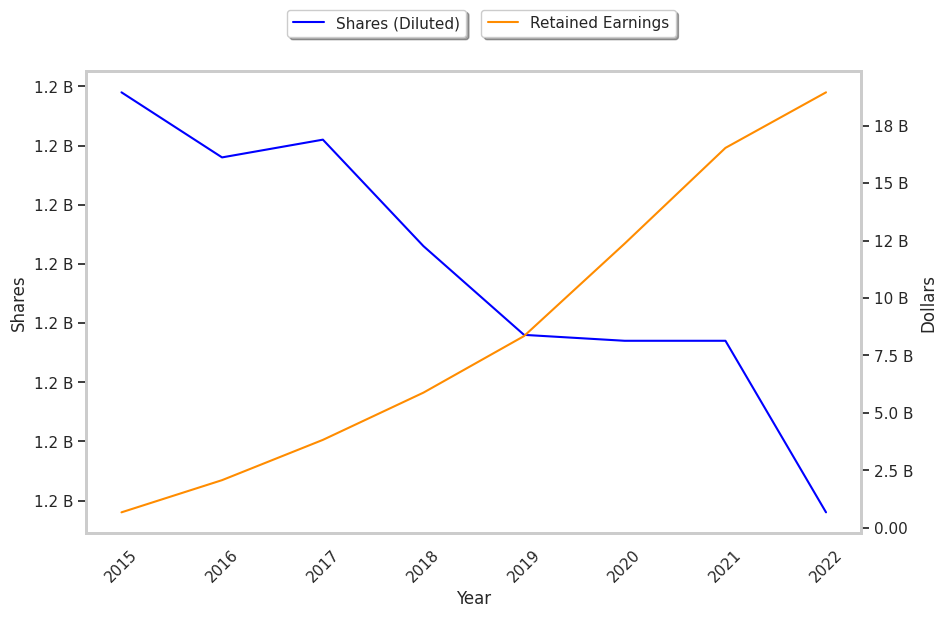

| Diluted Shares (MM) | 1,221 | 1,203 | 1,188 | 1,187 | 1,187 | 1,158 |

| Free Cash Flow (MM) | $3,198 | $6,300 | $4,758 | $6,965 | $6,700 | $6,514 |

| Capital Expenditures (MM) | -$667 | -$820 | -$687 | -$746 | -$903 | -$701 |

| Net Current Assets (MM) | n/a | n/a | $4,091 | $679 | -$1,502 | -$926 |

| Long Term Debt (MM) | n/a | n/a | $4,965 | $8,939 | $8,049 | $10,417 |

PayPal has strong margins with a stable trend, healthy debt levels, and positive EPS growth. Furthermore, PayPal has weak revenue growth and a flat capital expenditure trend, irregular cash flows, and just enough current assets to cover current liabilities.

A Very Low P/E Ratio but Trades Above Its Graham Number:

PayPal has a trailing twelve month P/E ratio of 16.8, compared to an average of 22.33 for the Consumer Discretionary sector. Based on its EPS guidance of $5.3, the company has a forward P/E ratio of 11.3. The company doesn't issue forward earnings guidance, and the compound average growth rate of its last 6 years of reported EPS is 6.0%. On this basis, the company's PEG ratio is 2.78, which suggests that it is overpriced. In contrast, the market is likely undervaluing PayPal in terms of its equity because its P/B ratio is 3.01 while the sector average is 3.12. The company's shares are currently trading 87.0% above their Graham number.

PayPal Has an Analyst Consensus of Strong Upside Potential:

The 40 analysts following PayPal have set target prices ranging from $55.04 to $119.56 per share, for an average of $78.25 with a buy rating. As of April 2023, the company is trading -23.3% away from its average target price, indicating that there is an analyst consensus of strong upside potential.

PayPal has a very low short interest because 1.7% of the company's shares are sold short. Institutions own 75.8% of the company's shares, and the insider ownership rate stands at 0.21%, suggesting a small amount of insider investors. The largest shareholder is Vanguard Group Inc, whose 8% stake in the company is worth $4,954,804,318.