Cloudflare logged a -0.8% change during today's afternoon session, and is now trading at a price of $58.91 per share.

Cloudflare returned gains of 9.0% last year, with its stock price reaching a high of $76.07 and a low of $37.37. Over the same period, the stock underperformed the S&P 500 index by -3.0%. As of April 2023, the company's 50-day average price was $61.99. CloudFlare, Inc. operates as a cloud services provider that delivers a range of services to businesses worldwide. Based in San Francisco, CA, the large-cap Technology company has 3,389 full time employees. Cloudflare has not offered a dividend during the last year.

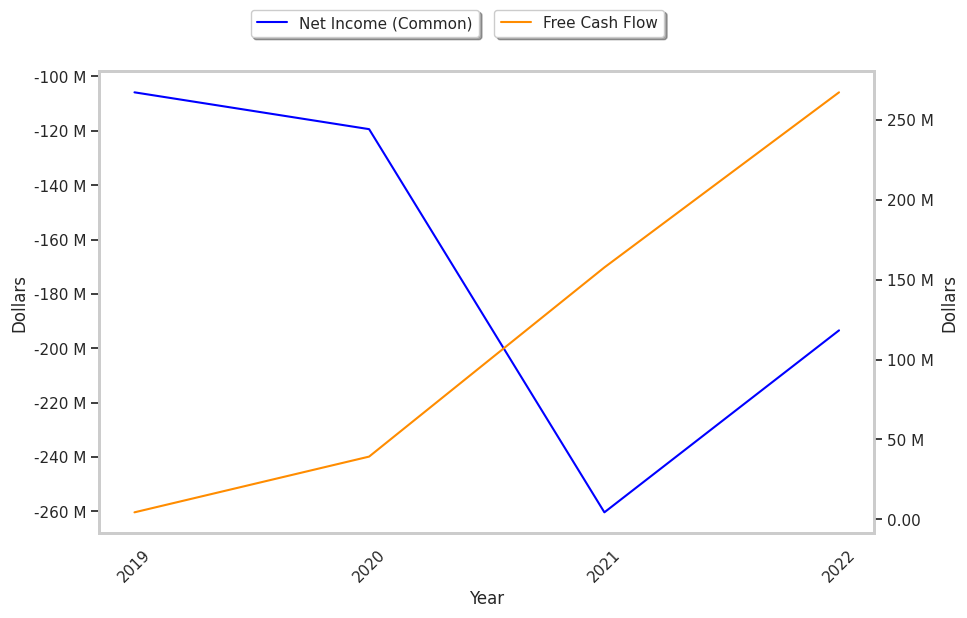

The Business Is Unprofitable and Its Balance Sheet Is Highly Leveraged:

| 2020-02-10 | 2021-02-25 | 2022-03-01 | 2023-02-24 | |

|---|---|---|---|---|

| Revenue (k) | $287,022 | $431,059 | $656,426 | $975,241 |

| Gross Margins | 78.0% | 77.0% | 78.0% | 76.0% |

| Operating Margins | -38% | -25% | -19% | -21% |

| Net Margins | -37.0% | -28.0% | -40.0% | -20.0% |

| Net Income (k) | -$105,828 | -$119,370 | -$260,309 | -$193,381 |

| Net Interest Expense (k) | $4,675 | -$18,376 | -$47,264 | $9,893 |

| Depreciation & Amort. (k) | -$29,479 | -$49,387 | -$66,607 | -$102,335 |

| Earnings Per Share | -$0.72 | -$0.4 | -$0.83 | -$0.59 |

| EPS Growth | n/a | 44.44% | -107.5% | 28.92% |

| Diluted Shares (k) | 146,306 | 299,774 | 314,543 | 326,332 |

| Free Cash Flow (k) | $4,372 | $39,246 | $157,634 | $267,201 |

| Capital Expenditures | -$43,289 | -$56,375 | -$92,986 | -$143,606 |

| Net Current Assets (k) | $584,876 | $566,243 | $395,144 | -$76,060 |

| Long Term Debt (k) | $10,506 | $383,275 | $1,146,877 | $1,436,192 |

| LT Debt to Equity | 0.01 | 0.47 | 1.41 | 2.3 |

Cloudflare has a pattern of improving cash flows, an excellent current ratio, and positive EPS growth. However, Cloudflare has slimmer gross margins than its peers, consistently negative margins with a positive growth rate, and high levels of debt. Finally, we note that Cloudflare has weak revenue growth and a flat capital expenditure trend.

Cloudflare does not have a meaningful trailing P/E ratio since its earnings per share are currently in the red. Based on its EPS guidance of $0.45, the company has a forward P/E ratio of 137.8. In comparison, the average P/E ratio for the Technology sector is 27.16. Furthermore, Cloudflare is likely overvalued compared to the book value of its equity, since its P/B ratio of 30.62 is higher than the sector average of 6.23.

Cloudflare Has an Average Rating of Hold:

The 23 analysts following Cloudflare have set target prices ranging from $43.0 to $90.0 per share, for an average of $70.13 with a hold rating. As of April 2023, the company is trading -11.6% away from its average target price, indicating that there is an analyst consensus of some upside potential.

Cloudflare has an average amount of shares sold short because 7.6% of the company's shares are sold short. Institutions own 89.2% of the company's shares, and the insider ownership rate stands at 0.97%, suggesting a small amount of insider investors. The largest shareholder is Morgan Stanley, whose 11% stake in the company is worth $1,892,159,209.