Shares of Technology sector company CrowdStrike moved -0.8% today, and are now trading at a price of $235.03. The large-cap stock's daily volume was 3,868,949 compared to its average volume of 3,194,419. The S&P 500 index returned a 1.0% performance.

CrowdStrike Holdings, Inc. provides cloud-delivered protection across endpoints and cloud workloads, identity, and data. The company is based in Austin and has 7,745 full time employees. Its market capitalization is $56,441,278,464.

43 analysts are following CrowdStrike and have set target prices ranging from $172.0 to $271.0 per share. On average, they have given the company a rating of buy. At today's prices, CRWD is trading 1.02% away from its average analyst target price of $232.65 per share.

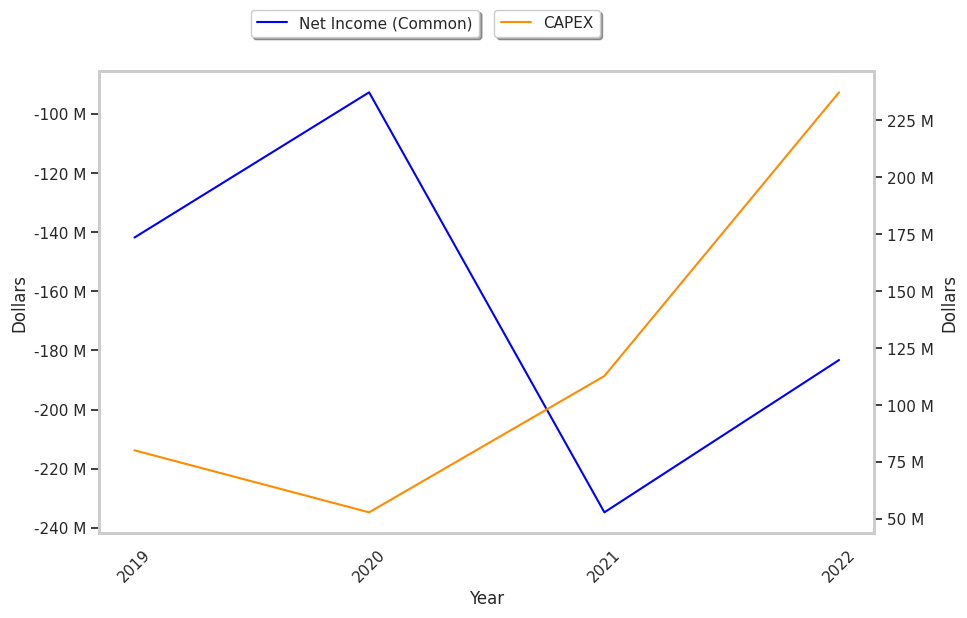

Over the last year, CRWD's share price has increased by 90.0%, which represents a difference of 76.0% when compared to the S&P 500. The stock's 52 week high is $238.48 per share whereas its 52 week low is $92.25. With average free cash flows of $225.28 Million that have been growing at an average rate of 45.9% over the last 6 years, CrowdStrike is in a position to continue its strong stock performance trend.

| Date Reported | Cash Flow from Operations ($ k) | Capital expenditures ($ k) | Free Cash Flow ($ k) | YoY Growth (%) |

|---|---|---|---|---|

| 2023 | 941,007 | 235,019 | 705,988 | 52.6 |

| 2022 | 574,784 | 112,143 | 462,641 | 52.3 |

| 2021 | 356,566 | 52,799 | 303,767 | 1438.45 |

| 2020 | 99,943 | 80,198 | 19,745 | 133.57 |

| 2019 | -22,968 | 35,851 | -58,819 | 27.98 |

| 2018 | -58,766 | 22,906 | -81,672 |