Today we're going to take a closer look at large-cap Industrials company Trane Technologies, whose shares are currently trading at $229.58. We've been asking ourselves whether the company is under or over valued at today's prices... let's perform a brief value analysis to find out!

Trane Technologies Has Elevated P/B and P/E Ratios:

Trane Technologies plc, together with its subsidiaries, designs, manufactures, sells, and services of solutions for heating, ventilation, air conditioning, custom, and custom and transport refrigeration in Ireland and internationally. The company belongs to the Industrials sector, which has an average price to earnings (P/E) ratio of 22.19 and an average price to book (P/B) ratio of 4.06. In contrast, Trane Technologies has a trailing 12 month P/E ratio of 26.8 and a P/B ratio of 7.83.

Trane Technologies's PEG ratio is 1.74, which shows that the stock is probably overvalued in terms of its estimated growth. For reference, a PEG ratio near or below 1 is a potential signal that a company is undervalued.

Growing Revenues With a Flat Capital Expenditure Trend:

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|---|

| Revenue (MM) | $12,344 | $13,076 | $12,455 | $14,136 | $15,992 | $17,327 |

| Revenue Growth | n/a | 5.93% | -4.75% | 13.5% | 13.12% | 8.35% |

| Operating Margins | 12% | 13% | 12% | 14% | 15% | 16% |

| Net Margins | 11% | 11% | 8% | 10% | 11% | 12% |

| Net Income (MM) | $1,358 | $1,428 | $991 | $1,457 | $1,796 | $2,001 |

| Net Interest Expense (MM) | $221 | $243 | $249 | $234 | $224 | $233 |

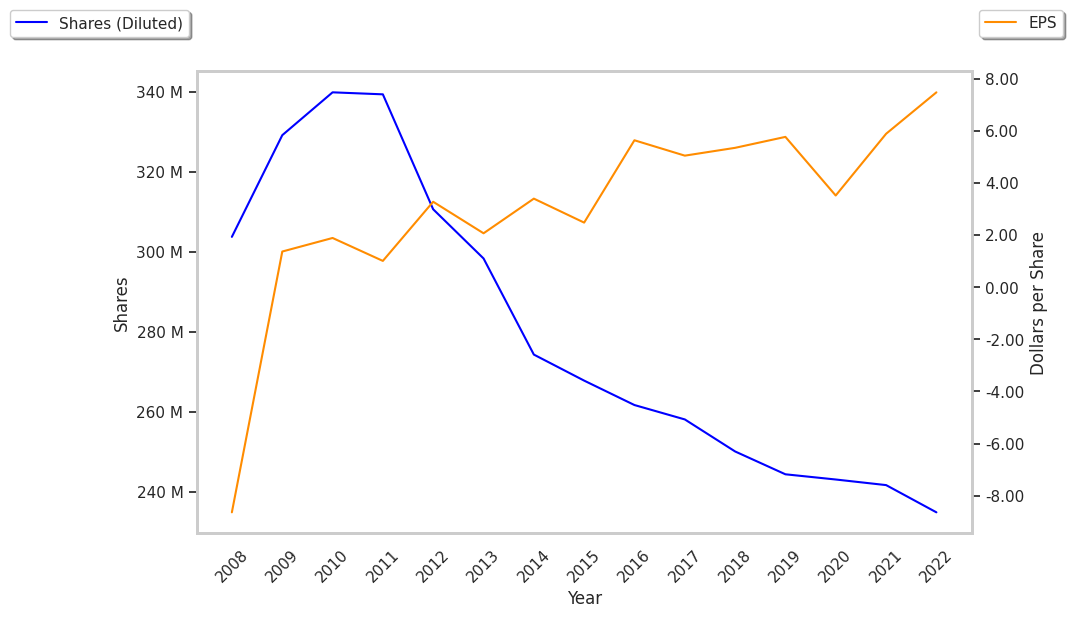

| Earnings Per Share | $5.35 | $5.77 | $3.52 | $5.87 | $7.48 | $8.48 |

| EPS Growth | n/a | 7.85% | -38.99% | 66.76% | 27.43% | 13.37% |

| Diluted Shares (MM) | 250 | 244 | 243 | 242 | 235 | 220 |

| Free Cash Flow (MM) | $1,123 | $1,714 | $1,620 | $1,371 | $1,407 | $1,956 |

| Capital Expenditures (MM) | $285 | $205 | $146 | $223 | $292 | $292 |

| Current Ratio | 1.33 | 1.77 | 1.59 | 1.36 | 1.12 | 1.29 |

| Long Term Debt (MM) | $3,741 | $4,923 | $4,496 | $4,492 | $3,788 | $4,476 |

| LT Debt to Equity | 0.53 | 0.68 | 0.7 | 0.72 | 0.62 | 0.67 |

Trane Technologies has growing revenues and a flat capital expenditure trend and decent operating margins with a stable trend. Additionally, the company's financial statements display positive EPS growth and healthy leverage. Furthermore, Trane Technologies has irregular cash flows.