Shares of Sarepta Therapeutics have moved -0.1% today, and are now trading at a price of $88.06. In contrast, the S&P 500 index saw a -0.0% change. Today's trading volume is 172,490 compared to the stock's average volume of 1,539,511.

Sarepta Therapeutics, Inc., a commercial-stage biopharmaceutical company, focuses on the discovery and development of RNA-targeted therapeutics, gene therapies, and other genetic therapeutic modalities for the treatment of rare diseases. Based in Cambridge, United States the company has 1,162 full time employees and a market cap of $8,237,722,624.

The company is now trading -37.23% away from its average analyst target price of $140.28 per share. The 18 analysts following the stock have set target prices ranging from $80.0 to $224.0, and on average give Sarepta Therapeutics a rating of buy.

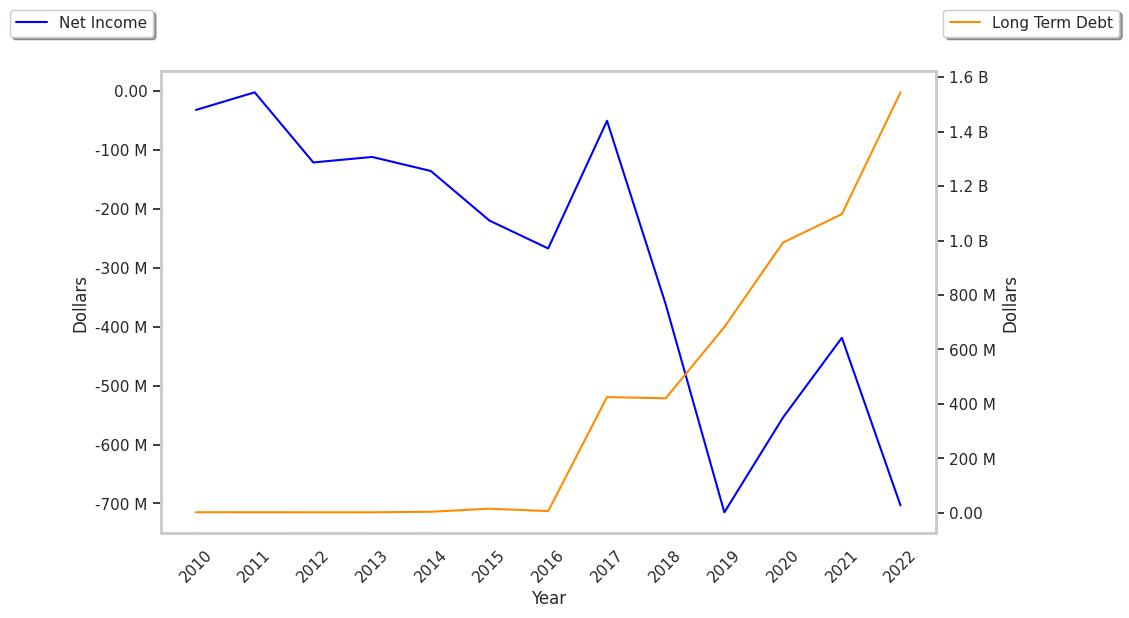

Over the last 12 months SRPT shares have declined by -26.0%, which represents a difference of -43.0% when compared to the S&P 500. The stock's 52 week high is $159.89 per share and its 52 week low is $55.25. Based on Sarepta Therapeutics's average net margin growth of 10.3% over the last 3 years, its core business remains strong and the stock price may recover in the long term.

| Date Reported | Total Revenue ($ k) | Net Profit ($ k) | Net Margins (%) | YoY Growth (%) |

|---|---|---|---|---|

| 2023 | 1,104,982 | -690,876 | -63 | 16.0 |

| 2022 | 933,013 | -703,488 | -75 | -25.0 |

| 2021 | 701,887 | -418,780 | -60 | 41.75 |

| 2020 | 540,099 | -554,128 | -103 | 45.21 |

| 2019 | 380,833 | -715,075 | -188 | -56.67 |

| 2018 | 301,034 | -361,918 | -120 |