We've been asking ourselves recently if the market has placed a fair valuation on Kinder Morgan. Let's dive into some of the fundamental values of this large-cap Utilities company to determine if there might be an opportunity here for value-minded investors.

Kinder Morgan's Valuation Is in Line With Its Sector Averages:

Kinder Morgan, Inc. operates as an energy infrastructure company in North America. The company belongs to the Utilities sector, which has an average price to earnings (P/E) ratio of 17.53 and an average price to book (P/B) ratio of 1.71. In contrast, Kinder Morgan has a trailing 12 month P/E ratio of 16.1 and a P/B ratio of 1.29.

Kinder Morgan's PEG ratio is 53.6, which shows that the stock is probably overvalued in terms of its estimated growth. For reference, a PEG ratio near or below 1 is a potential signal that a company is undervalued.

The Company May Be Profitable, but Its Balance Sheet Is Highly Leveraged:

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|---|

| Revenue (MM) | $14,144 | $13,209 | $11,700 | $16,610 | $19,200 | $15,875 |

| Revenue Growth | n/a | -6.61% | -11.42% | 41.97% | 15.59% | -17.32% |

| Operating Margins | 27% | 37% | 13% | 18% | 21% | 27% |

| Net Margins | 14% | 17% | 2% | 11% | 14% | 16% |

| Net Income (MM) | $1,919 | $2,239 | $180 | $1,850 | $2,625 | $2,561 |

| Net Interest Expense (MM) | $107 | $75 | $56 | $282 | $55 | $79 |

| Depreciation & Amort. (MM) | $2,297 | $2,411 | $2,164 | $2,135 | $2,186 | $2,237 |

| Free Cash Flow (MM) | $2,139 | $2,478 | $2,843 | $4,427 | $3,346 | $3,407 |

| Capital Expenditures (MM) | $2,904 | $2,270 | $1,707 | $1,281 | $1,621 | $2,166 |

| Current Ratio | 0.76 | 0.63 | 0.63 | 0.66 | 0.55 | 0.39 |

| Total Debt (MM) | $37,324 | $32,068 | $32,739 | $31,038 | $28,910 | $31,001 |

| Net Debt / EBITDA | 5.59 | 4.37 | 8.47 | 5.92 | 4.5 | 4.75 |

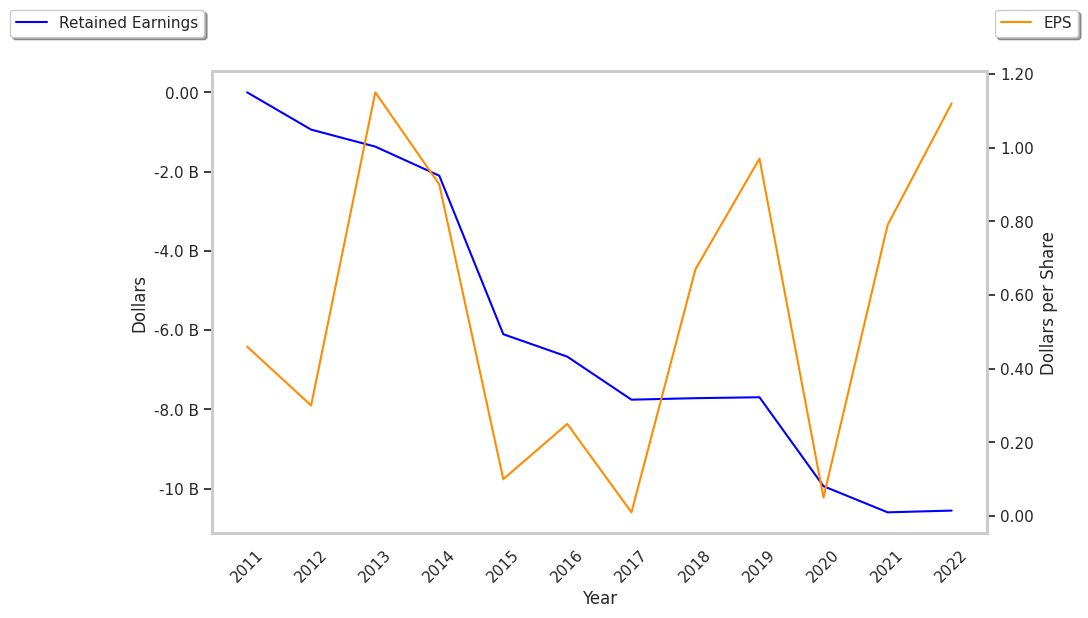

Kinder Morgan has growing revenues and decreasing reinvestment in the business, decent operating margins with a stable trend, and irregular cash flows. However, the firm has a highly leveraged balance sheet. Finally, we note that Kinder Morgan has positive expected EPS Growth.