Monster Beverage shares fell by -1.5% during the day's afternoon session, and are now trading at a price of $55.66. Is it time to buy the dip? To better answer that question, it's essential to check if the market is valuing the company's shares fairly in terms of its earnings and equity levels.

Monster Beverage's P/B and P/E Ratios Are Higher Than Average:

Monster Beverage Corporation, through its subsidiaries, engages in development, marketing, sale, and distribution of energy drink beverages and concentrates in the United States and internationally. The company belongs to the Consumer Staples sector, which has an average price to earnings (P/E) ratio of 21.21 and an average price to book (P/B) ratio of 4.12. In contrast, Monster Beverage has a trailing 12 month P/E ratio of 37.9 and a P/B ratio of 7.36.

Monster Beverage's PEG ratio is 1.59, which shows that the stock is probably overvalued in terms of its estimated growth. For reference, a PEG ratio near or below 1 is a potential signal that a company is undervalued.

The Company Has Lacking Information on Debt Levels:

| 2018 | 2019 | 2020 | 2021 | 2022 | 2023 | |

|---|---|---|---|---|---|---|

| Revenue (MM) | $3,807 | $4,201 | $4,599 | $5,541 | $6,311 | $6,923 |

| Revenue Growth | n/a | 10.34% | 9.47% | 20.5% | 13.89% | 9.69% |

| Gross Margins | 60% | 60% | 59% | 56% | 50% | 53% |

| Operating Margins | 34% | 33% | 36% | 32% | 25% | 28% |

| Net Margins | 26% | 26% | 31% | 25% | 19% | 23% |

| Net Income (MM) | $993 | $1,108 | $1,410 | $1,377 | $1,192 | $1,566 |

| Earnings Per Share | $8.8 | $10.13 | $13.18 | $12.86 | $11.17 | $14.77 |

| EPS Growth | n/a | 15.11% | 30.11% | -2.43% | -13.14% | 32.23% |

| Diluted Shares (MM) | 113 | 109 | 107 | 107 | 107 | 106 |

| Free Cash Flow (MM) | $1,100 | $1,012 | $1,315 | $1,112 | $699 | $1,419 |

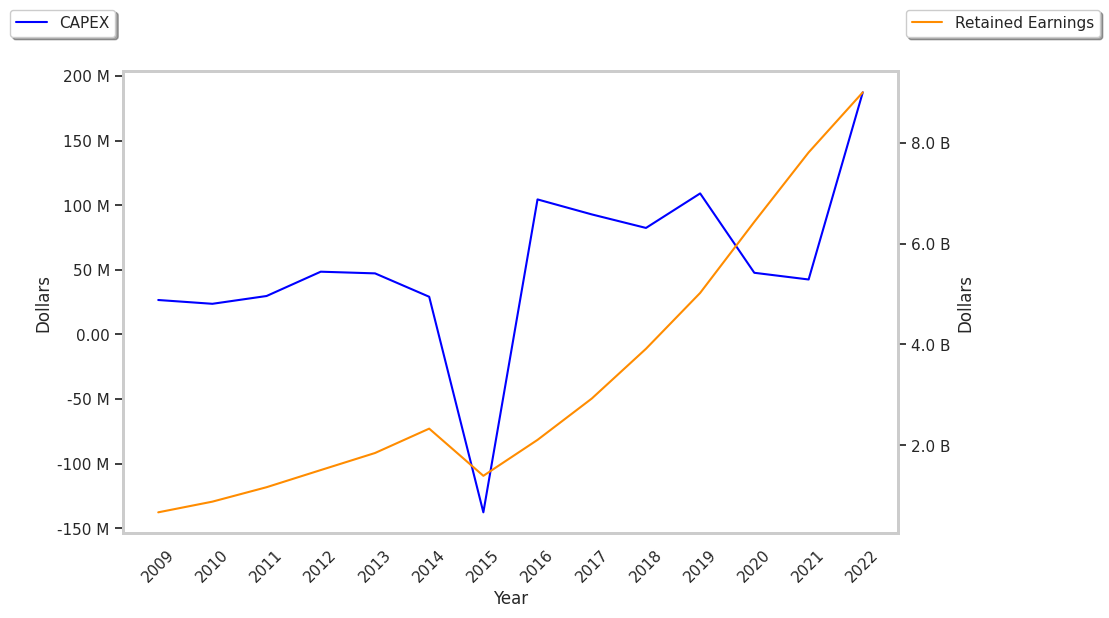

| Capital Expenditures (MM) | $62 | $102 | $49 | $44 | $189 | $163 |

| Current Ratio | 3.0 | 3.5 | 4.19 | 4.85 | 4.76 | 4.51 |

Monster Beverage has rapidly growing revenues and increasing reinvestment in the business and generally positive cash flows. Additionally, the company's financial statements display an excellent current ratio of 4.51 and positive EPS growth. Furthermore, Monster Beverage has similar gross margins to its peers and decent operating margins with a stable trend.