Kimball Electronics, Inc. (Nasdaq: KE) has released its 2023 Guiding Principles Report, emphasizing its commitment to sustainability and transparency. The report, titled "How We Are Winning Together The Kimball Way," provides insights into the company's sustainability activities, performance, and results for the calendar year 2023.

The report highlights several key metrics and accomplishments from 2023, showcasing the company's progress in various areas:

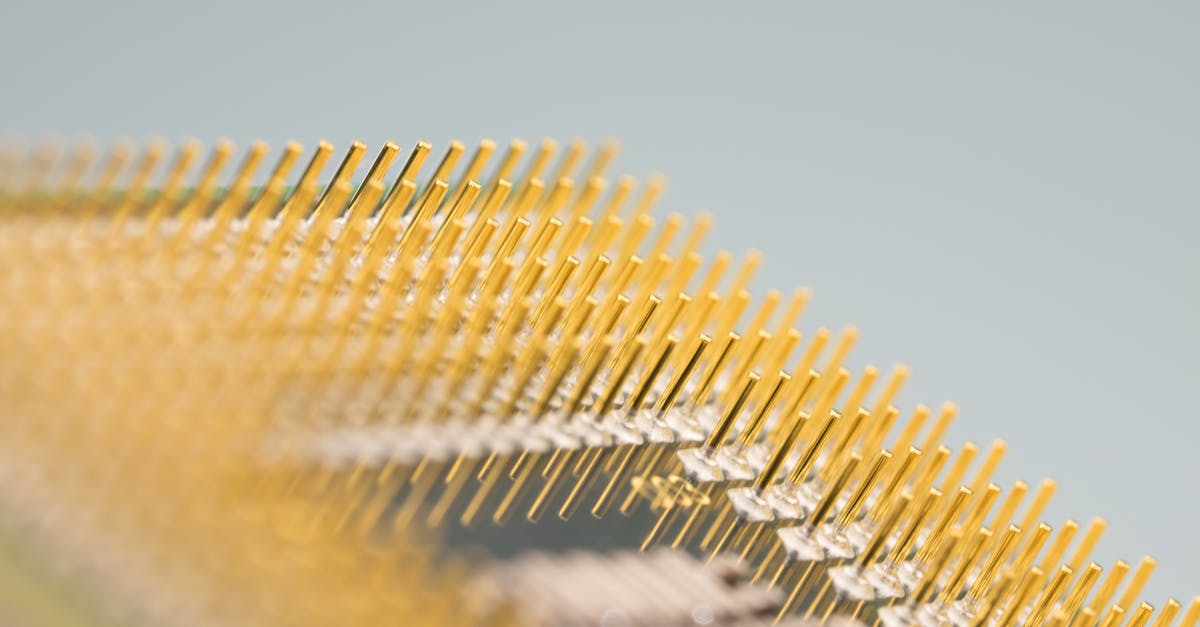

- Kimball Electronics achieved $324 million in revenue from "low carbon" or "no carbon" products in 2023, including climate control, smart energy management, smart meters, industrial controls, and green energy solutions.

- The company reported a significant 36% decrease in scope 1+2 market-based greenhouse gas emissions from its 2019 baseline, demonstrating a substantial reduction in its environmental impact.

- In terms of safety, Kimball Electronics achieved a commendable 27% reduction in its safety incident rate year over year, with the overall rate remaining well below industry averages.

- Notably, the company established three Employee Resource Groups aimed at offering allyship, mentorship, and sponsorship programs for underrepresented groups in the EMS industry, including women, LGBTQIA+ employees, and veterans.

- Kimball Electronics also demonstrated its commitment to social responsibility by donating over $310,000 worth of time and treasure to worthy causes worldwide.

Furthermore, the report underlines the company's dedication to aligning its sustainability priorities with global frameworks and standards, including the Global Reporting Initiative (GRI) Index, the Sustainability Accounting Standards Board's Electronic Manufacturing Services & Original Design Manufacturing Standard, and the Task Force on Climate-Related Financial Disclosures. Additionally, the report highlights how the company's sustainability efforts support the United Nations Global Compact's Ten Principles and the UN Sustainable Development Goals.

As a result of these announcements, the company's shares have moved -0.5% on the market, and are now trading at a price of $21.54. If you want to know more, read the company's complete 8-K report here.