Large-cap Telecommunications company AT&T has logged a -2.6% change today on a trading volume of 30,502,908. The average volume for the stock is 39,009,814.

AT&T Inc. provides telecommunications and technology services worldwide. Based in Dallas, United States the company has 152,740 full time employees and a market cap of $108,105,859,072. AT&T currently offers its equity investors a dividend that yields 7.1% per year.

The company is now trading -10.27% away from its average analyst target price of $16.85 per share. The 20 analysts following the stock have set target prices ranging from $7.54 to $23.58, and on average give AT&T a rating of hold.

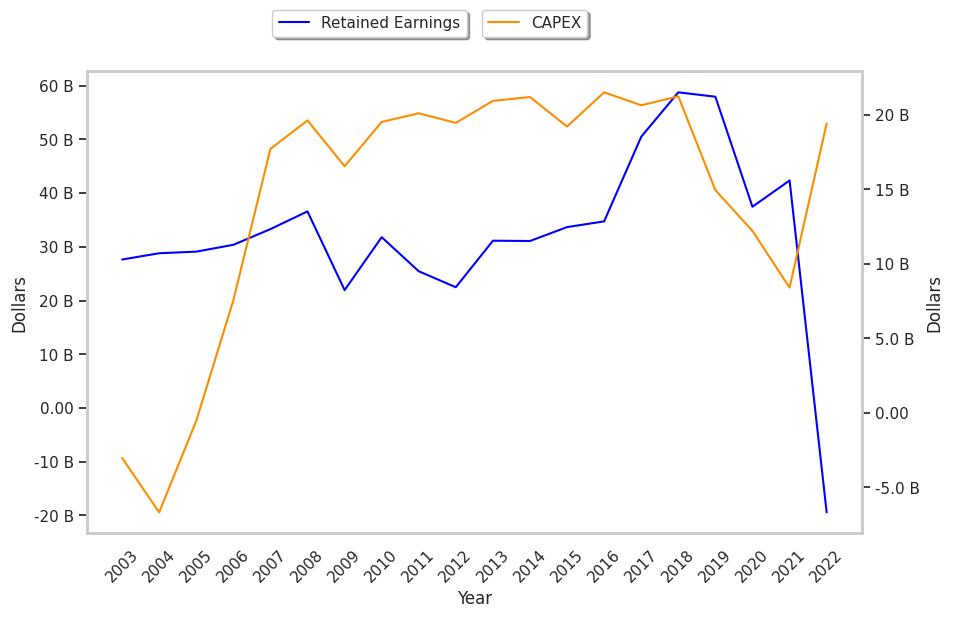

Over the last 12 months T shares have declined by -15.0%, which represents a difference of -25.0% when compared to the S&P 500. The stock's 52 week high is $21.53 per share and its 52 week low is $13.43. With its net margins declining an average -33.7% over the last 6 years, AT&T declining profitability gives us reason to believe its stock price will continue to underwhelm.

| Date Reported | Total Revenue ($ k) | Net Profit ($ k) | Net Margins (%) | YoY Growth (%) |

|---|---|---|---|---|

| 2023 | 121,442,000 | 1,233,000 | 1 | 0.0 |

| 2022 | 120,741,000 | 1,469,000 | 1 | -93.75 |

| 2021 | 134,038,000 | 21,479,000 | 16 | 1500.0 |

| 2020 | 143,050,000 | 1,355,000 | 1 | -87.5 |

| 2019 | 181,193,000 | 14,975,000 | 8 | -33.33 |

| 2018 | 170,756,000 | 19,953,000 | 12 |