Shares of Health Care sector company Hims & Hers Health moved 5.1% today, and are now trading at a price of $42.55. The Mid-Cap stock's daily volume was 18,373,598 compared to its average volume of 15,780,001. The S&P 500 index returned a -1.0% performance.

Hims & Hers Health, Inc. operates a telehealth platform that connects consumers to licensed healthcare professionals in the United States, the United Kingdom, and internationally. The company is based in San Francisco and has 1,046 full time employees. Its market capitalization is $9,296,281,600.

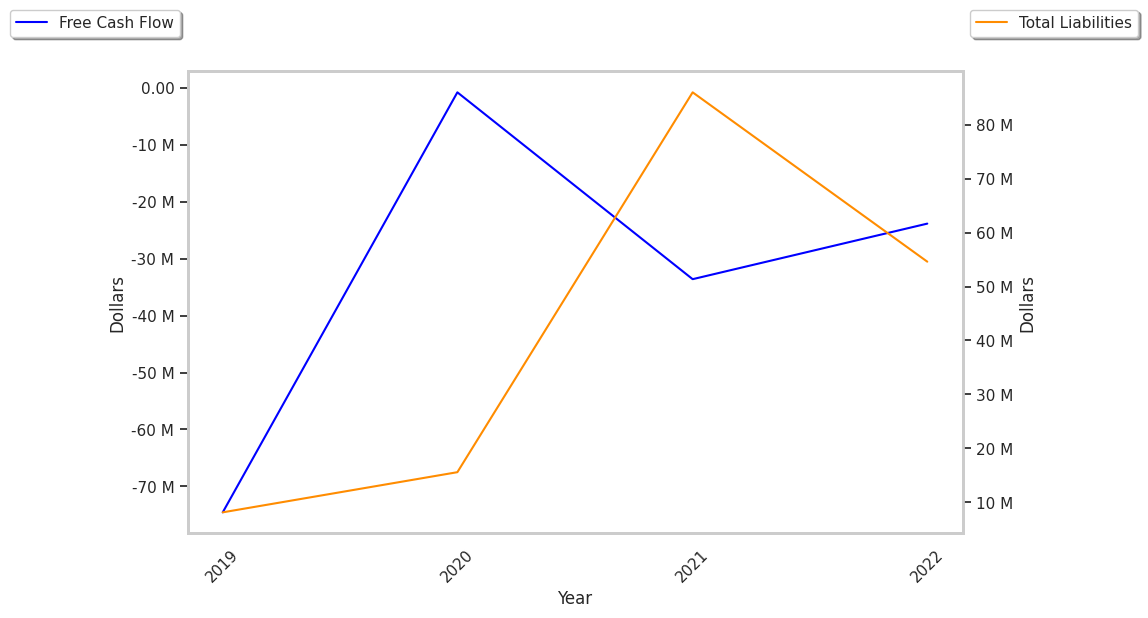

Over the last year, HIMS's share price has increased by 327.6%, which represents a difference of 307.6% when compared to the S&P 500. The stock's 52 week high is $46.01 per share whereas its 52 week low is $9.14. Hims & Hers Health has averaged free cash flows of $-17523400.0 over the last 4 years, but they have been increasing at a rate of 24.7%. Nonetheless, more cautious investors will probably avoid this stock until the business becomes firmly cash positive.

| Date Reported | Cash Flow from Operations ($ k) | Capital expenditures ($ k) | Free Cash Flow ($ k) | YoY Growth (%) |

|---|---|---|---|---|

| 2023 | 73,483 | 17,220 | 56,263 | 292.39 |

| 2022 | -26,531 | 2,714 | -29,245 | 17.02 |

| 2021 | -34,412 | 832 | -35,244 | -735.96 |

| 2020 | -2,479 | 1,737 | -4,216 | 94.39 |

| 2019 | -74,867 | 308 | -75,175 |